- Accounts Payable System Is An Application Of

- Accounts Payable System Requirements

- Accounts Payable System Aps

- Accounts Payable System Requirements

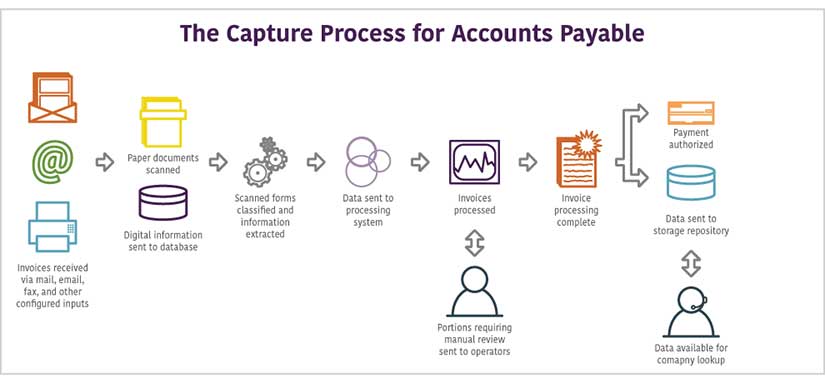

The Accounts Payable system provides many features that are user defined. These features allow you to adapt the system to your unique business environment and effectively manage your accounts payable. The features of the Accounts Payable system include. SutiAP, our online accounts payable software, helps automate invoice capture, auto matching, approvals, and payments while reducing processing time. Powerful analytics and reporting offer complete visibility and transparency in spending. It can be easily integrated with accounting systems and other third-party solutions to offer a seamless user. Accounts Payable Best Practice #1: Improve the Relationship with Your Suppliers.

May 15th, 2018Every forward-thinking business should be looking for new ways to improve how they run their business processes—even if they have always done it a certain way.

Your accounts payable (AP) department should be no exception.

In this article, we will share with you the most vital, accounts payable best practices to begin implementing into your AP department.

7 Best Practices for Accounts Payable: Responsibly and Efficiently Streamline Your AP Process

In most organizations, the accounts payable department doesn't get a lot of attention. However, when something goes wrong, your company can suffer greatly.

For example, let's say you run a manufacturing plant. In the event of a credit hold, your entire process could be looking at a shutdown since you would not be receiving the necessary materials to produce your product.

This is devastating for any organization!

Unfortunately, it is an all too familiar occurrence for companies without a highly efficient AP department.

There are a multitude of problems that will arise from an AP process that is barely limping along. Your AP department greatly influences your organization's cash flow, and there are opportunities that can be gained or lost from taking advantage of payment agreements with suppliers.

In the following AP best practices, we give you recommendations for improving your department through a combination of best practices that include dealing with suppliers and taking advantage of automation, harnessing technology, and using both to your advantage.

Accounts Payable Best Practice #1: Improve the Relationship with Your Suppliers

For our first accounts payable best practice, we believe it is essential you look at the relationship with your vendors and/or suppliers. If your supplier relationship is sometimes on edge because of a poor payment track record, you could look at integrating improvements into your AP process to ease this.

Your relationship with vendors is a critical part of any efficient, smooth-running accounts payable department.

Establishing trust goes a long way!

A healthy relationship with suppliers can help you through many situations—from needing supplies at a moment's notice to delaying a payment due date.

Be sure to pay your vendors on time as often as possible. When in a scenario where you're unable to pay by the deadline, be open about it. Contact your vendor as soon as you realize you won't be able to make the due date. Then, come up with a solution together, such as a payment plan you both can agree on.

Vendor relationships help you get better deals on the things you need to run your business. You also grow your network, as loyal vendors are likely to advocate for you to others.

Organize Your Vendor Data with a Supplier Portal

Another thing to consider, regarding establishing an improved relationship and interaction with your vendors, is to use technology to increase organization of data and allow for seamless communication.

'Digitize' your supplier information by digitally inputting payment details, invoices, and tax records in a centralized location. A supplier portal allows your suppliers to choose their payment method of choice, enter or update their payment and contact information, and access payment details at any time, in any place.

AP Pro Tip: Another added benefit of self-service supplier portals is error reduction. Real-time confirmation of Tax Identification Numbers (TIN validation), payment details, and address information helps takes the guesswork out of supplier information management.

Fewer errors and clear communication results in happy suppliers.

Accounts Payable Best Practice #2: Negotiate Your Terms

Now that you have improved your business-supplier relationship, you are now able to better negotiate your agreement.

Many contracts come with standard terms, like net 30 or net 60, but that doesn't mean that your supplier won't consider other options.

Contracts are meant to be negotiated!

So, why would a supplier offer you alternative terms outside the standard 30- or 60-day pay period?

Well, think about it this way: like any businessman, a vendor wants to make a sale as much as you would want to make a sale in your industry. So, if 10-15 additional days is the difference between making a sale or not, many vendors will be willing to bend.

Don't shy away from discussing your terms. However, remember to do so tactfully so you don't raise any red flags concerning your financial status. First, establish a relationship based on trust and communication. Then, proceed to negotiate terms that fit your organization's needs.

Accounts Payable Best Practice #3: Look for Discounts

The accounts payable process flow becomes more efficient when you owe less money. As a financial controller, it is in your best interest to find discounts on the supplies inventory and services you need. This particular accounts payable best practice focuses on just that.

Many vendors offer early payment discounts.

Take advantage of this!

Just like you want your customers to pay you on time and in full, your creditors want the same thing. They may offer an early payment discount. Find out which of your vendors will offer these discounts or even ask those that don't currently to do so.

Additionally, some creditors will reduce interest rates or offer discounts for a certain number of payments made on time and in full. Learn who charges interest or late fees. Take note and avoid paying late to those vendors.

Finally, bear in mind that if you order a large number of items, you can often receive a discount by buying in bulk. This tactic can end up saving you money in the long run. Just make sure you truly need large amounts of what you order beforehand.

Accounts Payable Best Practice #4: Ditch Paper and Change to Paperless Invoice Processing

As a leader at your organization, you are responsible for deciding which purchases must be made to run your AP department. Many vendors and suppliers send invoices when you buy from them. Not managing invoices could lead to late payments, extra fees, and damaged relationships.

Go Paperless When Possible

Electronic bills can make the accounts payable process easier. You don't have to wait on the mail to receive bills. Plus, paper invoices can easily be lost or damaged.

Not to mention, at an enterprise level, paper gets expensive!

Finally, your invoices arrive directly via email. This helps you to avoid late payments due to lost hard-copy bills.

Some vendors give you the option to receive a paper or electronic invoice. Encourage your suppliers to email invoices. Give them the contact information necessary to facilitate this.

Once you receive an online invoice, you can import it into your accounting software. You can also scan and upload paper invoices into the software so that all your bills are in the same place.

When possible, set up online payments for your regular vendors. You will need information like their account number, contact information, and amount owed.

With online billing, you have the added advantage of being able to manage payments from your phone or computer. You do not have to worry about any of the extra hassle that comes with traditional mail such as buying postage and printing or handwriting checks.

Additional Best Practices for Invoices:

As we've seen, paper invoicing represents a common issue. The right invoicing system can help you avoid payment mistakes and can save you money. Below are a few additional best practices for your AP invoices:

- Have a system in place for paying different invoice amounts – If the price you're paying is not the same as what's listed on the invoice, have a clear, well-defined system in place for explaining the reason.

- Train suppliers on your invoicing system – Send a letter to your suppliers explaining your invoicing policies—your system—and insist they use it. By making your system the norm for doing business, you will reduce potentially expensive errors and confusion with vendors. While it may feel somewhat demanding at first, insisting things are done according to your system will simplify your relationship with all of your suppliers.

- Separate invoicing duties – Have different individuals in your accounts payable department take on different roles. Some will approve purchases and receive ordered items while others will make payments. These employees should all have access to the same data so they can verify information and communicate, but keeping duties separate can reduce risk of fraud.

Accounts Payable Best Practice #5: Standardize Your Accounts Payable Workflow Processes

Repetition is the key to an efficient accounts payable process. Another best practice is to set up a standardized system for managing invoices from the time you receive a bill to when you pay it.

Standardize Your AP Invoice Workflow

Accounts Payable System Is An Application Of

Keep your invoices in a central location where you can easily locate them. Order the invoices by priority and date. For example, organize bills by the closest due dates to the due dates furthest away.

You can use an accounts payable 'aging report' to manage invoice due dates. An AP aging report helps you see which vendor payments are past their due dates.

In this type of report, you will see vendors on one side and on the other you will have various columns labeled as either 'current,' 'past due 1-30 days,' 'past due 31-50 days,' and so on. In the last column, you will see a row where the total amounts for each are listed.

Develop Efficient Workflows in Your Management.

Accounts Payable System Requirements

Your organization can improve the efficiency of your accounts payable processes by creating management workflows.

Management workflows can help you identify and improve blockages within your system and can also be helpful in streamlining process handoffs in the most efficient manner possible.

With workflow management, the system offers a wide range of features that allows your business to implement current objectives and make any alterations if those objectives change in the future.

The important features of workflow management include various invoice entry methods, receipt application and reporting, and credit and collection management.

Accounts Payable Best Practice #6: Reduce Unnecessary Steps in Your AP Process

It's now time to look at the next step of our accounts payable best practices: restructuring your current process.

Streamlining your AP process means different things within different organizational structures, but these basic principles remain true across all organizations:

• The larger a company is, the more possibility for AP processes to be disjointed.

• Invoice processing and payments distribution should happen in one central location.

• Having multiple AP departments in your business can create unnecessary redundancy.

How to Streamline Accounts Payable

Does your accounts payable process seem complicated and overwhelming?

Are you spending too many company resources on this part of your AP department?

There are a few ways to make your accounts payable department leaner and more efficient. Among the following best practices, there are a few points we have previously discussed, but it is worth it to review them once more here below.

Digitize and automate delivery receipts, dispute resolutions, and other tasks. If you can process invoices, receipts, and other necessary steps without active input from your team, you can save time and money. An automated (and digitized) system can also reduce human error, which will help cut costs.

Accounts Payable System Aps

Handle all payments from one location. If you have multiple locations and invoice service providers, suppliers and vendors for each of these sites, you may expend excessive resources on your AP process. By managing all of your payments from one location, you improve efficiency and save money on labor costs associated with these tasks.

Have one team member or group handling your accounts payable. You can reduce costs by having one person or one team handling all invoicing, bill receipts, bill payment processing, purchase order complication, and other parts of your AP system.

Accounts Payable Best Practice #7: Automating Your Accounts Payable

Perhaps the most important of all accounts payable best practices is to automate your system. In this article, we mentioned many ways in which automation can help your business run smoother and more efficiently. Automation can reduce the risk of losing an invoice, forgetting to make a payment, and simple human error.

Another benefit to using an automated system is that it enables you to set up red flag alerts for any unusual activity, helping you target fraud and mistakes. Automating your AP process also lets you save money on work costs by reducing the number of professional work hours needed to handle every task.

Instead, your team can focus on those critical projects that keep you moving forward.

Here at DocLib, our accounts payable automation software allows you to automate key business processes by eliminating data entry, automating the approval of supplier invoices, and verifying accuracy of payments.

Our solution compares the invoice amount with your purchase order and starts workflows based on business rules. DocLib Accounts Payable Automation can save your company time and money and improve supplier relations.

Do you want to know more about how to improve your accounts payable processes with AP an automation solution? Check out our article: Automated Accounts Payable: Everything You Need to Know.